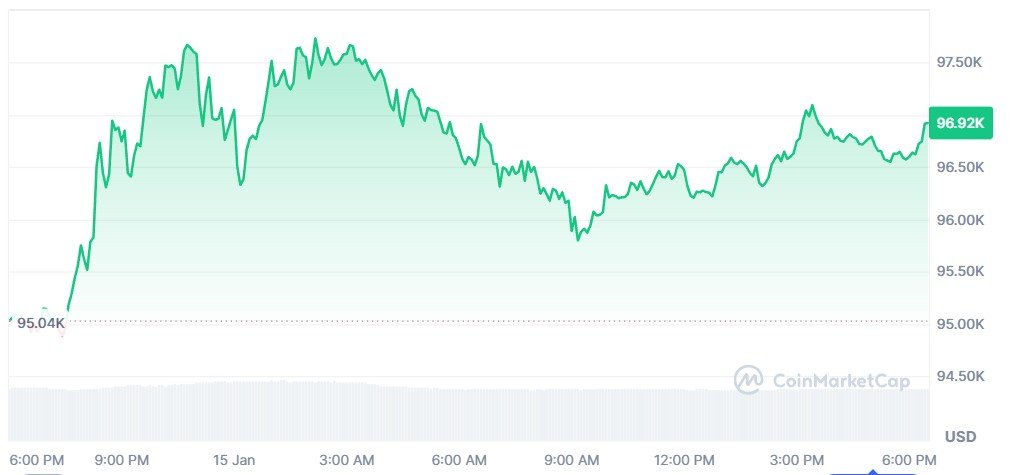

Bitcoin pushed to an eight-week high above $97,000, extending a January rally that has pulled the cryptocurrency back into the macro conversation as investors weigh cooling inflation prints against a growing sense that US policy is being shaped as much by politics as by central bankers.

Bitcoin was trading near $96,949 on Thursday, after an intraday high of $97,735, according to CoinMarketCap data.

Behind the price action is a debate about what, exactly, is tightening — and what is quietly easing.

In a note this week, HTX Research analyst Chloe Zheng argued Bitcoin’s move looks less like a technical bounce and more like the start of a “macro repricing” phase, driven by two forces: a shift in US system liquidity beginning in housing finance, and a repricing of geopolitical risk in the Middle East. Those themes have increasingly spilled into cross-asset trading, where “hard” stores of value have moved in tandem.

Housing finance and “shadow QE” claims

The first engine centers on the US mortgage market — specifically, a plan the Trump administration has discussed for housing-finance giants Fannie Mae and Freddie Mac to buy mortgage-backed securities (MBS), a step that HTX describes as a form of “shadow QE.”

Treasury Secretary Scott Bessent has said the goal of the MBS buybacks would be to match the Federal Reserve’s roughly $15 billion monthly roll-off of mortgage bonds — effectively offsetting part of the central bank’s ongoing quantitative tightening without formally changing Fed policy.

The mechanics matter because mortgage bonds sit at the core of US credit intermediation. When demand for MBS rises, spreads to Treasuries can compress, easing funding conditions and potentially freeing up balance-sheet capacity for banks and other intermediaries — a channel that can support risk assets even if headline rate policy looks unchanged.

Fannie Mae and Freddie Mac have already been increasing retained portfolios, lifting their combined positions to the highest level since 2021, with analysts estimating further potential growth.

Still, strategists caution that comparing the program to QE is as much narrative as it is plumbing. Unlike Fed asset purchases, GSE buying doesn’t automatically create bank reserves; its market impact depends on how the purchases are funded, how spreads respond, and whether easier mortgage credit translates into broader lending and liquidity.

Middle East risk, oil, and inflation tail risks

The second engine is geopolitical. Iran has faced a renewed wave of unrest centered around Tehran’s Grand Bazaar, a symbolic and economic hub that played a key role in the 1979 revolution — raising fresh questions about regime stability and the risk of escalation.

Oil markets have reacted to the volatility. Reuters reported crude prices surged as traders priced in a “geopolitical trifecta,” including Iran, and described prices rising about 9% in a week amid concerns over shipping routes and supply disruption risk premia.

That matters for Bitcoin because energy shocks often reintroduce inflation tail risks at the same time financial conditions are being influenced by fiscal and quasi-fiscal channels. Even when spot inflation looks calmer, investors tend to pay for protection against scenarios where inflation re-accelerates or policy credibility comes under strain.

Why “stores of value” are moving together

The common thread is uncertainty about the anchor: how much of the future path of rates, liquidity, and inflation is set by independent monetary policy — and how much is increasingly shaped by politics and geopolitics.

This week’s US inflation report added to that mix. December CPI came in softer than some forecasts on the surface, even as Reuters flagged firmer undercurrents in components like food and the gap between CPI and the Fed-preferred PCE measure.

At the same time, broader questions about central bank independence have returned to markets, after the Trump administration’s actions and rhetoric around Federal Reserve Chair Jerome Powell drew public pushback from US and global officials.

Against that backdrop, gold, silver and other precious metal hit new highs, reflecting a bid for assets seen as insulated from policy discretion.

HTX’s framing — that Bitcoin is reacting early to liquidity and inflation-risk dynamics — fits a pattern traders have seen before: crypto often behaves like a high-beta expression of the “hard asset” trade, particularly when real yields are perceived to be drifting lower or when the credibility of policy frameworks is questioned.

Whether that develops into a sustained repricing phase will likely hinge on two things markets haven’t resolved: how durable the housing-finance bid proves to be, and whether Middle East tensions translate into a lasting oil shock — or fade back into the background noise that has repeatedly whipsawed global risk appetite.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Editorial Policy. Parts of this article were drafted/ researched with the assistance of AI tools and subsequently reviewed, edited, and verified by the author and our editorial team to ensure accuracy and journalistic integrity. The final version reflects human editorial judgment and fact-checking. AI Policy.

Image Credits: CoinMarketCap, Canva