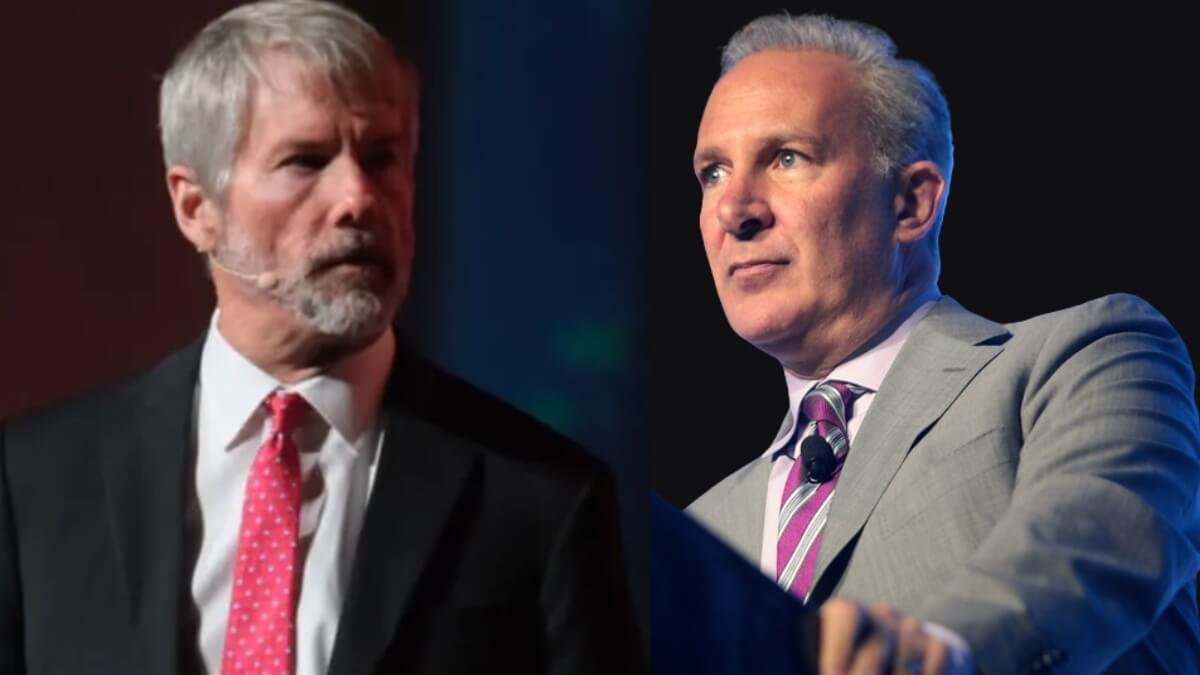

Peter Schiff, outspoken gold advocate and CEO of Euro Pacific Capital, has once again taken aim at Michael Saylor’s Bitcoin strategy. In a post on X today, Schiff argued that MicroStrategy (now Strategy) is sitting on fragile “paper gains” that would evaporate under real-world liquidity tests.

Schiff pointed out that Strategy’s $47.33 billion in Bitcoin purchases are showing a 47 % paper gain, roughly in line with a hypothetical gold strategy. Had Saylor invested the same amounts into gold at the same times, Schiff contends, the gain would be about 30 %. He stressed, however, that the critical difference lies in liquidity.

Schiff argues that Strategy’s 47% “gain” on a $47.33 billion Bitcoin investment pales in practical terms. Had Saylor deployed capital into gold at the same times, Schiff contends, the paper gain would manage 30%. But the real difference, he suggests, lies in liquidity and market impact. Schiff warns that offloading $70 billion in Bitcoin would crash markets, while unloading $70 billion in gold could be done with minimal disruption.

“If the biggest Bitcoin buyer and promoter bailed out entirely, mass liquidations would ensue,” he warned. “All of the paper profits would vanish, and MSTR would realize a huge loss. It’s clear the firm would be much stronger had Saylor bought gold instead of Bitcoin.”

Saylor today shared a chart on X highlighting Strategy’s Bitcoin portfolio performance. As of September 28, the firm holds 639,835 BTC valued at $70.01 billion, showing a 47.93 % gain.

Read Also: Bitcoin Censorship Resistance Tested with Luke Dashjr Hard Fork Controversy

Institutional Reluctance to Bitcoin

Despite its size and financial metrics, Strategy continues to face skepticism from traditional market gatekeepers. Earlier this month, Robinhood was included in the S&P 500 index, while Strategy was passed over—despite meeting all eligibility requirements for the first time. The company reported $10 billion in Q2 net income and $14 billion in operating income, figures that would typically guarantee inclusion.

Robinhood’s addition was attributed to its scale, fintech diversification, and liquidity. Strategy’s omission, however, is widely believed to stem from its unique and potentially volatile exposure to Bitcoin.

Bloomberg’s Senior ETF Analyst Eric Balchunas commented on this on X: “Why wasn’t $MSTR allowed into the S&P 500 Index despite meeting all the criteria? Because the ‘Committee’ said no. You have to realize SPX is essentially an active fund run by a secret committee.”

The snub shows how Bitcoin-heavy corporate treasuries remain a step too far for conservative benchmarks, even as crypto gains traction across financial markets.

Capital Structure Concerns

Schiff’s critique also aligns with broader concerns about Strategy’s financing methods. The firm has relied heavily on equity issuance through at-the-market (ATM) offerings to fund Bitcoin purchases. This has diluted shareholders and left the company increasingly exposed to swings in BTC’s price. Earlier this year, Strategy reported its fifth straight quarterly loss and launched a $21 billion equity raise to continue accumulating Bitcoin.

Meanwhile, insiders have sold stock at well-timed intervals. Earlier this month, Strategy’s general counsel sold $3.6 million in shares shortly before a price slide in both Bitcoin and the company’s stock, fueling speculation of poor insider confidence.

Gold vs. Bitcoin Has Been A Long Debate

Schiff’s criticism reflects a long-standing divide. The veteran gold advocate, known for predicting the 2008 financial crisis, has repeatedly dismissed Bitcoin as a speculative bubble. He argues gold’s liquidity, historical stability, and broad acceptance make it a safer hedge against monetary risk. While Schiff has recently softened his rhetoric slightly—admitting some regret over not buying Bitcoin earlier—he still insists that BTC remains more cult-like than sound money.

Read Also: Bitcoin Mining Infra Becomes the New Battleground for Big Tech

Disclaimer: This article is for informational purposes only and does not constitute investment advice.