In Brief

- Theo introduced thGOLD, a yield-bearing tokenized gold product designed for DeFi use.

- Yield is generated via the MG999 On-Chain Gold Fund, which conducts secured lending to established gold retailers, starting with Mustafa Gold (Singapore), using gold inventory as collateral.

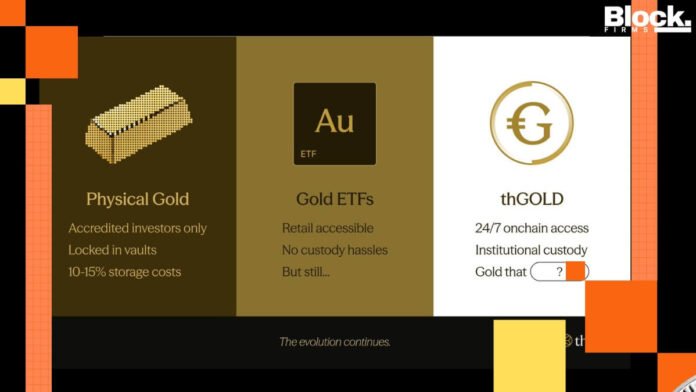

A new tokenized gold product is trying to solve an old problem for bullion investors: gold is a “negative carry” asset that typically costs money to store and insure, and most onchain versions mainly replicate that passive exposure.

Theo, a tokenization platform founded by former traders from firms including Optiver and IMC, today launched thGOLD, an ERC-20 token designed to track spot gold while also generating yield by lending gold into a retail supply chain. The token targets roughly 2% annual yield by routing exposure through a Singapore-domiciled structure called the MG999 On-Chain Gold Fund, which lends physical gold to established jewelry and gold retailers for working capital.

Why now: rate-cut expectations and fresh geopolitical risk

Gold has been back in focus as markets price in a lower-rate trajectory—reducing the opportunity cost of holding non-yielding assets—and as geopolitical tensions reassert themselves. In early January, U.S. strikes in Venezuela boosted safe-haven demand for gold, with traders explicitly tying the move to heightened geopolitical uncertainty and expectations for Federal Reserve easing.

Those dynamics have been amplified by gold’s outsized recent performance. Gold surged 64% in 2025, following strong demand from central banks and investors, and continued climbing in early 2026.

How thGOLD works?

Theo positions thGOLD as “tokenized gold that earns,” using a fund-and-lending structure rather than a pure warehouse receipt.

Ari Pingle, Co-founder of Theo, mentioned: “Most tokenized gold today is just a wrapper. You’re paying fees to hold an asset that does nothing.”

According to Ari, thGOLD actually work in DeFi.

“it earns yield, it trades on real venues, and you can use it as collateral. That’s what tokenization should deliver,” Ari said.

According to Theo:

- Underlying vehicle: MG999 is described as a secured private credit strategy that lends physical gold to established jewelers in “Grade A jurisdictions” needing working capital, beginning with Mustafa Gold in Singapore

- Manager and tokenization partner: The fund is managed by FundBridge Capital, with tokenization infrastructure provided by Libeara, a platform incubated by Standard Chartered’s SC Ventures.

- Regulatory framing: Theo’s docs describe MG999 as a Singapore Unit Trust under the Monetary Authority of Singapore regulatory environment.

- Yield source: Yield is generated from interest on secured lending backed by gold inventory.

- Risk buffers: Theo’s docs state there is security over gold inventory, restrictions to established jewelers in “Grade A jurisdictions,” and a 20% first-loss buffer held by the fund sponsor.

The MG999 structure itself predates the thGOLD launch: Libeara previously disclosed MG999’s establishment in December 2025 and said its infrastructure already supports over $1 billion in “compliant and secure on-chain assets.”

A key difference vs. PAXG and Tether Gold: redemption mechanics

Tokenized gold already exists at scale, dominated by products like PAX Gold (PAXG) and Tether Gold (XAU₮/XAUT). Paxos describes PAXG as a token where one token represents one fine troy ounce of an LBMA London Good Delivery gold bar held in professional vaults, with holders having ownership rights to that gold under Paxos custody. Tether similarly markets XAUT as a token providing ownership of physical gold and offers delivery/redemption in Switzerland under specific conditions.

thGOLD is structured differently.

- thGOLD minting/redemption is limited to whitelisted users who pass KYC/AML.

- Mint requests settle T+3 to T+7, with pricing based on the LBMA morning gold price at mint finalization.

- Redemptions return value in USDC and explicitly state no claims over underlying physical gold.

That design may appeal to DeFi users who prioritize composability and stablecoin settlement, but it also reframes what the buyer ultimately owns: exposure to a tokenized fund-linked instrument rather than title to specific bullion bars.

“Gold that yields” introduces a different risk profile

Theo’s pitch is that yield transforms gold from idle collateral into a productive onchain primitive—something that can be traded, posted as collateral, and potentially integrated across DeFi strategies.

But yield also implies additional risk vectors. Instead of primarily custody and issuer risk (common in gold-backed tokens), thGOLD’s return depends on secured lending performance, including counterparty, collateral management, and operational execution across the underlying retail borrower(s). Theo highlights protections like collateral security and a first-loss buffer, but the product is still exposed to borrower and market structure risks that traditional vaulted tokens minimize.

The bigger trend: tokenized commodities are growing

Tokenized commodities have expanded alongside the broader real-world asset (RWA) push. RWA.xyz, a dashboard tracking onchain RWAs, shows tokenized commodities as a multi-billion-dollar category (with tokenized precious metals a major subset).

thGOLD is an attempt to move tokenization past “digital wrappers” and toward structured products that behave more like onchain money-market funds, but anchored to a commodity benchmark.

More From BlockFirms

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Read our Editorial Policy. Parts of this article were drafted/ researched with the assistance of AI tools and subsequently reviewed, edited, and verified by the author and our editorial team to ensure accuracy and journalistic integrity. The final version reflects human editorial judgment and fact-checking. Read our AI Policy.

Image Credits: Theo, Canva