- Taurus and Parfin have integrated their platforms to offer an end-to-end digital asset solution for regulated financial institutions — covering custody, tokenization, execution, and compliance.

- The partnership enables Taurus to expand into Latin America, leveraging Parfin’s regional presence, while Parfin gains access to Taurus’s European client base and FINMA-regulated infrastructure.

Taurus, the Swiss fintech backed by Deutsche Bank, has partnered with Parfin, a Latin American blockchain infrastructure provider supported by Accenture. The partnership seeks to deliver an integrated, institutional-grade digital asset management platform for banks and asset managers operating across Europe and Latin America.

The alliance integrates Taurus’s regulated custody and tokenization platform — trusted by major financial institutions including UBS, Deutsche Bank, and State Street — with Parfin’s orchestration and execution capabilities, including its custody-agnostic Rayls platform. The result is a unified stack that streamlines the issuance, custody, and trading of digital assets such as cryptocurrencies, tokenized securities, and central bank digital currencies (CBDCs).

Taurus Co-Founder and Managing Partner, Lamine Brahimi, said: “Together, we’re providing a scalable, high-performance solution that supports institutions as they expand their digital asset capabilities.”

Taurus, founded in 2018, has positioned itself as a cornerstone of Europe’s tokenization infrastructure. Its suite includes Taurus-PROTECT (for secure custody) and Taurus-CAPITAL (for compliant issuance and lifecycle management of digital assets). These tools are increasingly being adopted by traditional financial institutions looking to modernize their backends for tokenized products.

Parfin, a 2019 startup launched by former BTG Pactual bankers and blockchain technologists, has quickly gained traction in Latin America and beyond. Its flagship product Rayls serves as a unified finance (UniFi) platform, enabling traditional financial institutions to access blockchain-based assets and services with rigorous compliance and security protocols. Parfin’s inclusion in the Kinexys accelerator — a Web3 initiative backed by J.P. Morgan — further solidified its standing among next-gen fintech providers.

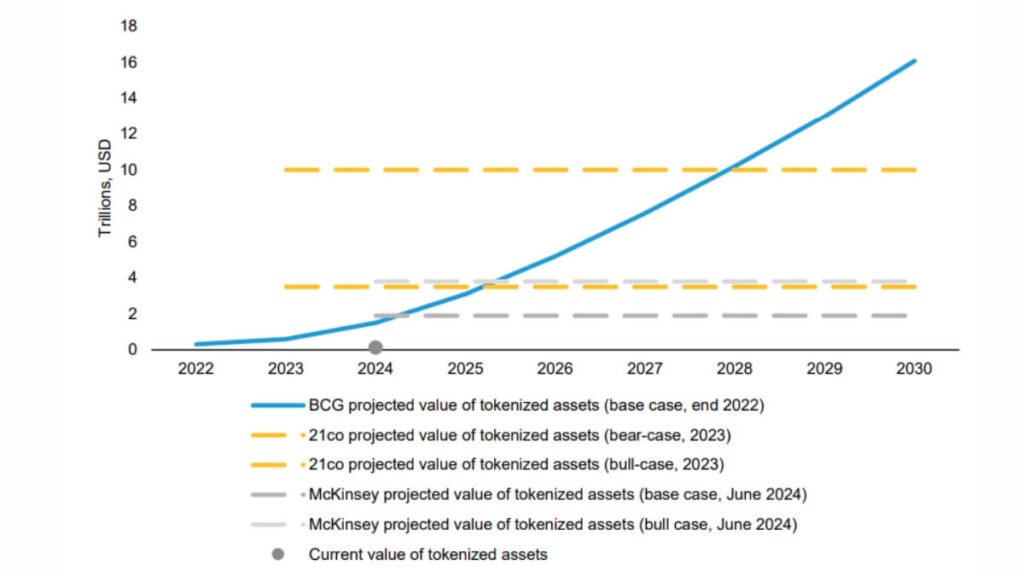

The partnership comes at a time when institutions worldwide accelerate their efforts to digitize and tokenize financial instruments. Analysts estimate that the global tokenized assets market could reach even higher than $16 trillion by 2030.

Tokenized assets market could reach $10 trillion by 2030, according to a report by digital asset manager 21.co. Their analysis projects a market value between $3.5 trillion in a bear-case scenario and $10 trillion in a bull-case scenario by the end of the decade, as traditional financial institutions increasingly adopt blockchain technology.

It’s important to note that various firms have provided differing forecasts for the tokenization market. For instance, Boston Consulting Group estimated a potential $16 trillion market by 2030, while McKinsey & Co. offered a more conservative estimate of less than $2 trillion by the same year.

The integration of Taurus and Parfin addresses key bottlenecks: fragmented custody, limited compliance tooling, and disconnected execution infrastructure.

“This integration means we can offer financial institutions real-time wallet visibility, seamless settlement, and customizable policy enforcement through one interface,” said Marcos Viriato, Co-Founder and CEO of Parfin. “It’s about reducing operational risk while increasing flexibility.”

Marcos Viriato, Co-Founder and CEO of Parfin, mentioned the integration as an important step for institutions seeking global-standard infrastructure.

“At Parfin, we aim to serve as a trusted orchestration layer for financial institutions, with a custody-agnostic and interoperable platform. The integration with Taurus enhances that flexibility, allowing our clients to choose the solutions that best meet their needs in a secure and compliant environment,” Marcos said.

The move also marks Taurus’s formal entry into Latin America, leveraging Parfin’s deep regional presence and institutional client base. In return, Parfin gains access to Taurus’s European clientele and its proven custody framework — a step that could unlock more cross-continental financial flows in the digital asset ecosystem.

Both firms stress that the platform is ready for large-scale institutional deployment, with full support for hardware security modules (HSMs), automated policy controls, and interoperability with legacy financial systems.

Read Also: Presearch Unveils Privacy-First Advertiser Dashboard to Rival Google AdTech