India has taken its most sweeping step on indirect taxes since 2017, compressing the Goods and Services Tax structure to two standard rates—5% and 18%—and carving out a special 40% band for “sin” and super-luxury items such as tobacco and high-end automobiles.

Health and life insurance premiums are to be fully exempt from GST, reversing an 18% levy that had long irked households and policy advocates.

The decisions emerged from the 56th GST Council meeting on September 3, chaired by Finance Minister Nirmala Sitharaman. The decision was hailed by Prime Minister Narendra Modi as “next-generation reforms.” Implementation for most goods and services begins on 22 September, timing that catches the front edge of India’s long festive season.

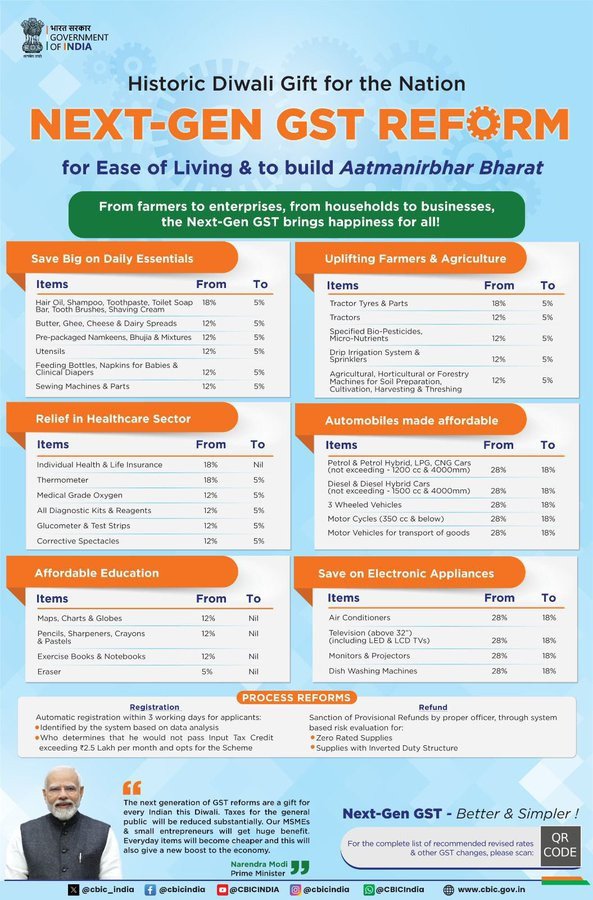

The changes are far from cosmetic. A long list of everyday personal-care staples—shampoo, toothpaste and hair oil—shifts to 5% from 18%, while “aspirational” durables such as televisions and air-conditioners, plus small cars and motorcycles, drop from 28% to 18%. In parallel, a 40% rate will replace today’s complex cess mechanism on sin goods, tightening policy coherence and attempting to ring-fence revenue from items with negative externalities. Let’s have a quick look on old versus new GST rates.

A marquee social policy move came with the GST waiver on individual health and life insurance, which authorities framed as relief for households and a spur to coverage. Exemption takes effect on September 22, even as insurers weigh input-tax-credit frictions that could partially blunt pass-through. Insurance penetration had slipped to about 3.7% of GDP in FY24 by one estimate, underscoring the policy intent to rebuild momentum toward the regulator’s “Insurance for All by 2047” vision.

The prime minister publicly endorsed the package on Wednesday night, praising the Council’s consensus and arguing that citizens, farmers and small businesses will benefit, while the Finance Minister’s office amplified the “Independence Day pledge” framing.

Prime Minister Narendra Modi wrote on X: “The Union Government had prepared a detailed proposal for broad-based GST rate rationalisation and process reforms, aimed at ease of living for the common man and strengthening the economy.”

“The wide ranging reforms will improve lives of our citizens and ensure ease of doing business for all, especially small traders and businesses.”

Government releases confirm the effective date, sectoral lists and the special 40% band design, though some implementation details around sin goods may roll out in phases.

Below, we unpack the “why,” the macro arithmetic, the states’ calculus, and the transmission to companies and households—alongside the geopolitics hovering over this decision.

Why it matters: demand, simplicity and the politics of federal revenue

The four-slab GST mosaic—5%, 12%, 18% and 28% plus cesses—bred classification disputes and compliance costs, while inviting persistent lobbying around rate inversions. A two-rate core with a discrete “sin” band is administratively cleaner and likely reduces boundary disputes that fuel litigation and working-capital blockages.

The rate compression lands when inflation is unusually soft and consumption has been patchy, offering room to absorb near-term revenue losses while trying to re-ignite volumes in FMCG, consumer durables and small vehicles. The Reserve Bank of India only last month trimmed its FY26 inflation projection near 3.1%, indicating policy space for relative price changes without risking the target band.

The optics also matter. A simpler GST is a long-standing ask from business lobbies and state officials alike, while insurance exemptions map neatly to political priorities around health risk, financial inclusion and middle-class sentiment. Government press statements stressed “ease of living” and “ease of doing business,” mirroring the government’s broader narrative of streamlining to attract investment and boost formalization.

What forced India’s hand: the domestic slowdown—and U.S. tariffs at the margins

Two catalysts converged. First, domestic consumption has shown bouts of unevenness despite headline GDP resilience, with urban households trading down and rural recovery slower than hoped. Governments typically target such slowdowns with consumption-side relief near festive months, amplifying seasonal demand impulses. Second, geopolitics intruded. Several market analysts explicitly tied the reform timing to an effort to offset U.S. tariff headwinds, after Washington’s sharp tariff rhetoric and measures against Indian exports complicated the external environment.

New Delhi nonetheless pushed back on that framing. In live Q&A, the finance minister said reforms were not linked to tariffs, a point carried by major business outlets.

The political economy likely blends both explanations: a policy window opened by low inflation and a strategic need to sustain domestic demand amid external uncertainty. The government has simultaneously sought to diversify export markets, another tell that trade frictions shaped the macro backdrop, even if officials avoid that explicit linkage.

The tariff question: is this a counterpunch to Washington?

The answer is nuanced. Reuters and AP linked the GST cuts to tariff pressures, noting fresh U.S. measures and the risk to tens of billions in shipments.

Another Reuters piece sketched a broader cooling in U.S.–India ties, with Delhi recalibrating toward strategic autonomy in an unsettled world. Against that canvas, tax relief at home is an obvious offset— cushioning exporters’ order pipelines through stronger domestic demand while companies rotate toward Europe, Latin America and Southeast Asia. Delhi’s rebuttal does not negate the macro logic; it simply reframes the initiative as a domestic reform rather than a retaliatory move.

What exactly gets cheaper—and who gains first

Three transmission channels stand out.

FMCG and personal care. The Council’s lists show popular personal-care SKUs shifting to 5% from 18%, with industry voices signalling either price cuts or higher grammage in small packs. Large brands will calibrate pass-through against input-credit changes, but retailers should see quick shelf-tag moves in soap, shampoo, toothpaste and hair oil—classic mass-market baskets. Brokerage previews and market coverage flagged FMCG stocks as early beneficiaries.

Consumer durables and electronics. Televisions and air-conditioners moving to 18% from 28% unlock room for headline price cuts or value-add features at similar sticker prices. Expect aggressive festive promotions as brands chase volumes, with distributors watching working-capital impacts from faster inventory rotation.

Small cars and two-wheelers. The reduction to 18% on small cars and motorcycles under 300 cc hits the most price-sensitive slice of the auto market. The change should particularly help entry-level two-wheelers and compact cars, where pandemic scarring and fuel-price worries had suppressed demand. Automakers with dominant small-car portfolios appear positioned to benefit disproportionately.

Insurance: from 18% to zero—what households save and what insurers juggle

Eliminating GST on individual life and health policies directly lowers out-of-pocket costs for policyholders. Several analysts estimate meaningful effective reductions, a clear nudge toward protection and medical cover in a country with a stubborn protection gap. However, exemption means insurers cannot claim input tax credits on services they buy, which could marginally raise their cost base and partly temper pass-through.

Net household savings should still be positive, especially for term and medical policies with large annual premiums; the industry will fine-tune pricing once guidance on input credits and transitional provisions is clarified.

The move aligns with the IRDAI’s “Insurance for All by 2047” agenda, which aims to expand coverage across citizens and enterprises.

The fiscal math: how much revenue is at risk—and how authorities plan to cope

Reuters pegs the gross revenue impact at roughly ₹480 billion, split between the Centre and states under the GST sharing formula. Context helps here. Gross GST collections reached around ₹22.1 trillion in FY25, and August 2025 inflows printed at ₹1.86 trillion, up 6.5% year-on-year. On that base, the static revenue hit looks near two percent of annual collections, before dynamic effects. Authorities are betting that stronger volumes will recoup a chunk through higher consumption, stronger compliance, and second-order boosts to corporate profitability and wages.

States, however, are already signalling concerns. Opposition-ruled states warn that income could drop substantially without a backstop, and some ministers want a dedicated levy beyond the 40% band to compensate. The compensation-cess architecture, extended through March 2026 to repay pandemic-era loans, is winding down as borrowings are retired. Some reporting suggests a small surplus might be available if cess collections run beyond repayment needs, which the Council could allocate to cushion the transition. Whether that fund is politically and arithmetically sufficient will be a central bargaining point in the months ahead.

Two mitigants could soften the blow. First, the 40% “sin” rate consolidates and simplifies today’s cess, potentially stabilising yield from narrow, inelastic bases such as tobacco. Second, procedural reforms agreed alongside rate cuts—faster refunds, easier registrations and a long-pending appellate tribunal—can lift compliance, shrink disputes and reduce the cash-flow tax on growth. Improved compliance efficiency is not a panacea, yet the experience since 2017 shows steady gains as systems mature, nudging buoyancy higher.

Inflation and consumer welfare: how prices may actually behave

The direct first-round impact on headline CPI should be disinflationary, even if pass-through is uneven. The CPI basket assigns meaningful weight to “miscellaneous” services and to personal care; deeper cuts on mass-market FMCG items create immediate relief for low-and-middle income households.

Eyeballing published CPI weights suggests personal care and effects at roughly 3.9% for the combined basket, while transport and communication carry the heaviest sub-weights within “miscellaneous.”

Price cuts on small cars do not directly enter CPI until reflected through owner-equivalent cost proxies, but cheaper durables can free budgets for other spending.

If firms pass through half to two-thirds of the tax relief into prices, headline CPI could fall several basis points near term, with a larger perceived improvement in household budgets due to salience.

The RBI’s benign inflation projections provide space for this transition without jeopardizing the nominal anchor.

Businesses: pricing, margins and working capital through the transition

Consumer companies must quickly decide on sticker-price cuts versus grammage increases, a choice shaped by competitive dynamics and input-credit positions.

Where supply chains are tax-efficient and scale is high, headline MRP reductions may dominate; where distributors demand protection, grammage increases could appear first.

Durables brands are likely to lean into festival promotions, helped by the psychological effect of “no longer in the 28% bucket.”

Automakers will calibrate cash discounts against new ex-factory tax incidence, mindful that dealerships hold inventory purchased at old rates and may need transitional credit relief to avoid margin squeezes.

Insurers face a different optimisation problem. Exemption removes output tax but blocks input credits on IT, distribution and claims-processing services. That shift raises effective costs unless procurement structures are re-engineered.

In competitive retail segments, negative optics around raising base premiums may force firms to absorb some cost pressure, tightening margins even as volumes climb. Over time, scale and digital operating leverage could restore profitability, particularly if the IRDAI’s distribution reforms and “Bima Trinity” initiatives expand the addressable market.

For MSMEs, two developments help. The simpler slab structure reduces classification edge-cases, while process reforms promise faster refunds, easier registrations and an appellate outlet to clear backlogs. Working-capital release from quicker refunds is a genuine easing for small manufacturers, particularly those with long receivable cycles or exporter exposure.

States and Centre: the federal bargain gets tested again

India’s GST was born as a grand federal compromise, with a five-year compensation promise that expired in 2022 and a cess extended to clear pandemic-era loans. A large rate cut resurrects familiar tensions.

Several state ministers have already demanded guaranteed compensation formulas, warning of budgetary strain if GST income dips significantly. The Centre’s argument rests on buoyancy—more consumption, better compliance and a cleaner structure expanding the base.

The new 40% band is also designed to protect fiscal space around items with low elasticity, but the distribution of that revenue across Centre and states will be scrutinised closely.

The Council appears to be weighing phased implementation where needed, mindful of the loan-repayment and cess-closure timelines.

Was this inevitable: the long road to rate rationalisation

India has circled this destination for a decade. The 2015 committee on the revenue-neutral rate estimated an RNR between 15% and 15.5%, while recommending a trajectory toward fewer rates and a distinct high band for demerit goods.

Today’s 5% and 18% structure with a 40% sin rate broadly maps to that intellectual framework. The Council has intermittently pruned anomalies since 2017, yet the final step needed political choreography and macro cover—both of which materialised this year.

Market reaction: consumer shares bid, autos watch the fine print

Equity markets had tracked the reform chatter through late August, with consumer and auto stocks responding to leaks and previews. Coverage highlighted likely beneficiaries among large FMCG names, while autos rallied on the prospect of a lower incidence for small cars.

As details emerged, FMCG outperformed, whereas auto stocks traded more cautiously pending clarity on definitions within the “special rate” for luxury vehicles and EVs.

This split reaction mirrors underlying economics: FMCG tax cuts transmit quickly, while auto demand is more sensitive to finance costs and household balance sheets.

The macro outlook: how growth, inflation and the fiscal may evolve

Near-term growth arithmetic improves as lower effective prices encourage volume growth in staples and entry-level durables. If households choose grammage-adjusted bargains rather than saving the tax cut, consumption’s contribution to GDP could lift visibly during the festive quarter.

Inflation’s first-round effect should be lower, helping the RBI maintain an accommodative stance for longer while keeping real rates supportive of investment.

The fiscal position worsens mechanically at first; however, stronger nominal consumption, corporate profitability and imports tied to durables demand typically recycle into GST over several quarters, narrowing the gap. Authorities will point to August revenue momentum and FY25 totals as evidence that buoyancy can carry weight here.

The long-term bet is formalization. Simpler rate architecture plus dispute-resolution capacity can raise voluntary compliance and shrink the informal premium.

If the 40% band remains narrow and predictable, it can anchor sin-good revenues without distorting broader price signals. The insurance exemption nudges households toward risk cover, improving financial resilience and potentially reducing catastrophic healthcare shocks that depress consumption cycles. That logic complements the IRDAI’s 2047 targets and dovetails with the government’s stated aim of widening safety nets through market mechanisms.

What to watch next: five practical signposts

1) Pass-through behaviour. Track MRP cuts versus grammage increases across FMCG categories over the next six weeks. Higher pass-through means stronger near-term disinflation and faster volume response.

2) Dealer inventory support in autos and durables. Transitional credits and OEM support will determine how quickly showroom prices reflect the new incidence. The speed of price resets is crucial for festive sales velocity.

3) States’ compensation bargain. Expect intense negotiations around a temporary backstop using any cess surplus or a calibrated sharing of the 40% band. Watch communiqués from opposition-ruled states closely.

4) Tribunal and refund plumbing. The promised GST Appellate Tribunal and faster refunds can unlock working capital and reduce litigation. Delivery by year-end would meaningfully boost confidence among MSMEs.

5) Clarifications on sin-band implementation. Dates and scope matter for tobacco, high-end cars and beverages. If the special rate replaces cess seamlessly, revenue volatility should fall.

The bottom line

India’s GST reform is both a simplification and a stimulus. It sacrifices some near-term revenue to buy affordability for households and headroom for businesses, gambling that volumes and compliance gains will pay back the loss.

The Council has chosen a moment of low inflation and geopolitical cross-winds to make the shift, deflecting suggestions that it merely counters U.S. tariffs while quietly addressing the macro uncertainty they create.

The insurance exemption is a strong social-policy signal, aligning taxation with public-health and financial-inclusion aims. The federal bargain remains the fragile centre of this story; how quickly Delhi and the states agree a compensation pathway will determine whether this “next-generation” GST endures as a pro-growth pivot or becomes a fiscal squabble.

For now, the Council has opted for clarity over complexity, and for demand over caution. If execution matches the ambition, the long-run payoff could be a broader base, fewer disputes and a tax system that reflects a more confident, consumption-driven India.

Editor’s note on sources. This analysis draws on agency reporting and official communication by the Government of India departments confirming the two-rate structure, the special 40% band, the insurance exemption and the September 22 start. It incorporates market and sector reporting on expected price and volume effects, and situates the decision against the RBI’s inflation projections. The long-term section references the 2015 RNR report which anticipated a narrow set of rates and a demerit band, providing intellectual lineage for today’s design.

Read Also: Pradeep Bhandari Urges India to Build Strategic Bitcoin Reserve

Disclaimer: This article is for informational purposes only and does not constitute investment advice.

AI Disclaimer: Parts of this article were researched, compiled, and drafted with the help of AI tools and reviewed by our editorial team for accuracy and adherence to our standards.