Bitcoin has tumbled more than 34% from its recent all-time high of $122,750, slipping to lows near $80,760 on November 21, as per CoinMarketCap Bitcoin Data. This is also one of the steepest pullbacks of the cycle. The rout triggered more than $2 billion in crypto derivatives liquidations over 24 hours – the largest single-day flush since October’s drawdown – with long Bitcoin positions accounting for nearly half of the unwinding.

The sell-off pushed the world’s largest cryptocurrency toward a psychological $85,000 support zone, intensifying debate about market froth, leverage and investor complacency. Yet Michael Saylor, founder and chairman of Strategy, continues to project unwavering confidence in the asset.

Saylor Reasserts Treasury Strategy Amid Index Debate

Responding to discussions about MSCI index classification, Saylor reiterated that Strategy is “not a fund, not a trust, and not a holding company,” but a publicly traded operating firm with a $500 million software business and a treasury model built around Bitcoin.

He highlighted the company’s expanding structured-finance products, noting more than $7.7 billion in notional value issued this year through a series of digital credit instruments – including STRK, STRF, STRD, STRC and STRE. Earlier this year, the company launched Stretch (STRC), a Bitcoin-backed credit instrument offering variable monthly USD yields to institutional and retail buyers.

“Funds and trusts passively hold assets,” Saylor wrote on X. “We create, structure, issue and operate… Our mission remains unchanged: to build the world’s first digital monetary institution on a foundation of sound money and financial innovation.”

Strategy’s Risk Appetite Tested During Volatility

Saylor argued that the company is engineered for extreme volatility. “The company is built to take an 80% to 90% drawdown and keep on ticking,” he told Fox Business in a recent interview, adding that Bitcoin remains the “ultimate digital opportunity.”

He pointed to historical precedent, noting that during the 2022 crypto winter, Strategy increased its holdings even as Bitcoin traded roughly 50% below the company’s average cost basis.

Michael Saylor recently predicted Bitcoin to reach $150,000 by end of this year, $1 million over next 4-8 years, and $20 million over next 20 years.

Analysts Split Between Long-Term Optimism and Near-Term Caution

While Saylor maintains a long-term conviction, other industry analysts warn that the current downturn could deepen before stabilising.

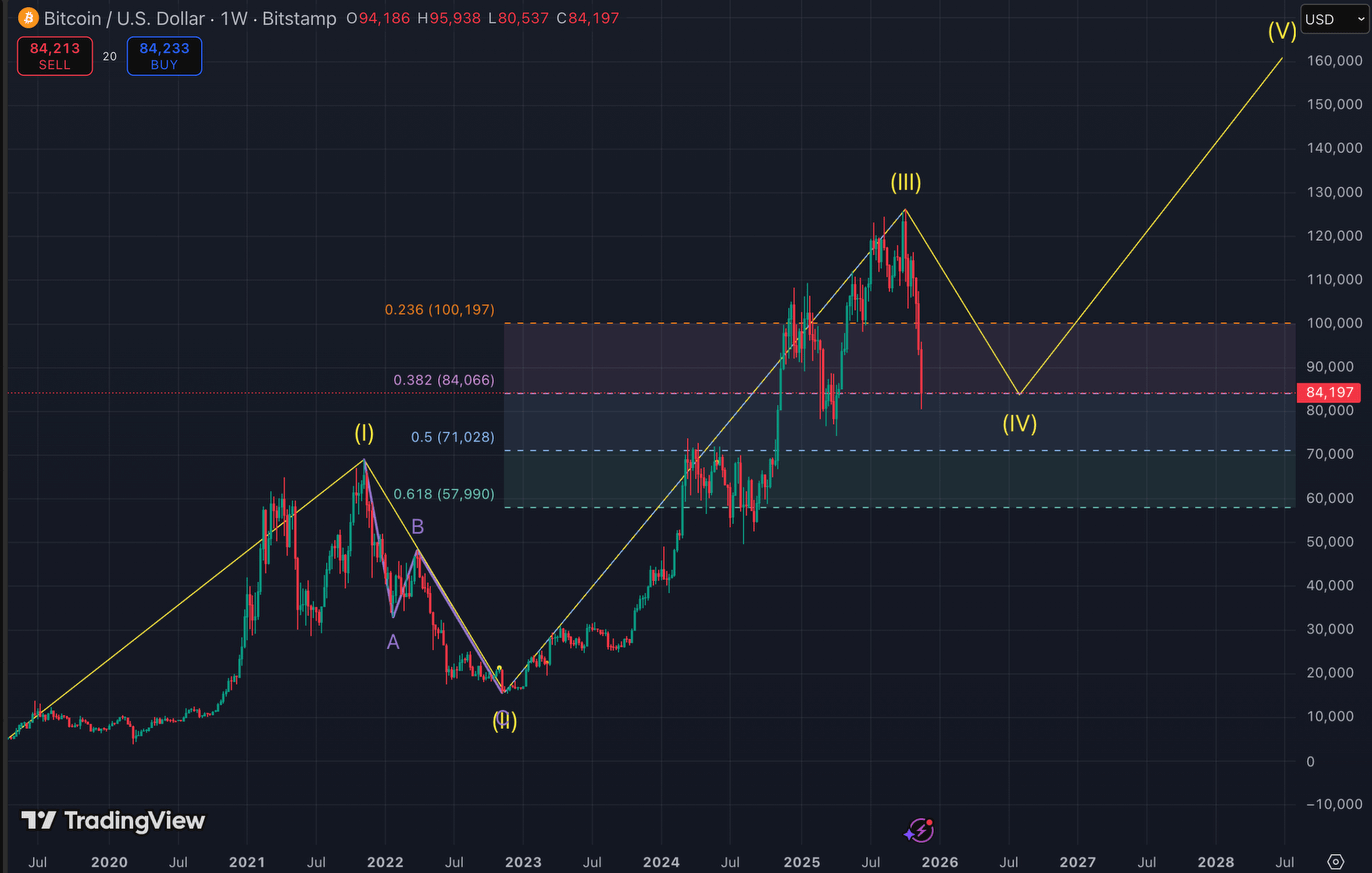

John Glover, CIO at Ledn and former Barclays MD, said Bitcoin’s decline to the 38.2% Fibonacci retracement was expected, though the speed of the fall surprised him. He characterised the slump as “panic selling” by weak longs and suggested that accumulation zones may be developing.

However, he cautioned that volatility will likely persist. Glover expects Bitcoin may eventually test the 50% retracement level around $72,000, predicting a bottom could form over the next “five to seven months.” He maintains a longer-term bullish view, forecasting a Wave V advance to $150,000–$170,000 by 2027–28.

Broader Market Voices: From Mega-Bulls to Measured Skeptics

This week’s turbulence has revived earlier cycle forecasts from prominent industry figures:

- Changpeng Zhao, Binance founder, said earlier this year that Bitcoin could reach $500,000 to $1 million this cycle, citing accelerating global demand.

- Ray Dalio, founder of Bridgewater Associates, confirmed he holds about 1% of his portfolio in Bitcoin, describing it as a long-term, asymmetric asset. Yet he warned that Bitcoin is “not ready” for a global reserve role, pointing to transparency concerns and future technological risks such as quantum computing.

Several institutional research houses have also urged caution. Analysts at JPMorgan and Goldman Sachs recently noted that Bitcoin’s rapid ascent since early 2025 was increasingly fuelled by leverage and aggressive retail inflows – dynamics that tend to amplify corrections. However, both firms maintain that structurally higher institutional participation, ETF flows and sovereign adoption offer longer-term support.

Resilience Narrative Against a Volatile Backdrop

The latest sell-off marks one of Bitcoin’s most violent corrections since the FTX-era volatility in 2022. Yet the drawdown also highlights a familiar pattern in previous bull cycles, where sharp deleveraging phases punctuate broader uptrends.

For Saylor and other long-term advocates, the setback reinforces their argument that Bitcoin’s path remains noisy but directionally upward. For more cautious analysts, the sudden drop serves as a reminder that the asset remains highly sensitive to sentiment, liquidity and leverage.

Whether the current downturn proves a mid-cycle reset or the start of a deeper consolidation period may depend on how quickly markets absorb remaining leverage – and whether long-term buyers continue stepping in.

Read Also:

Disclaimer: This article is for informational purposes only and does not constitute investment advice.