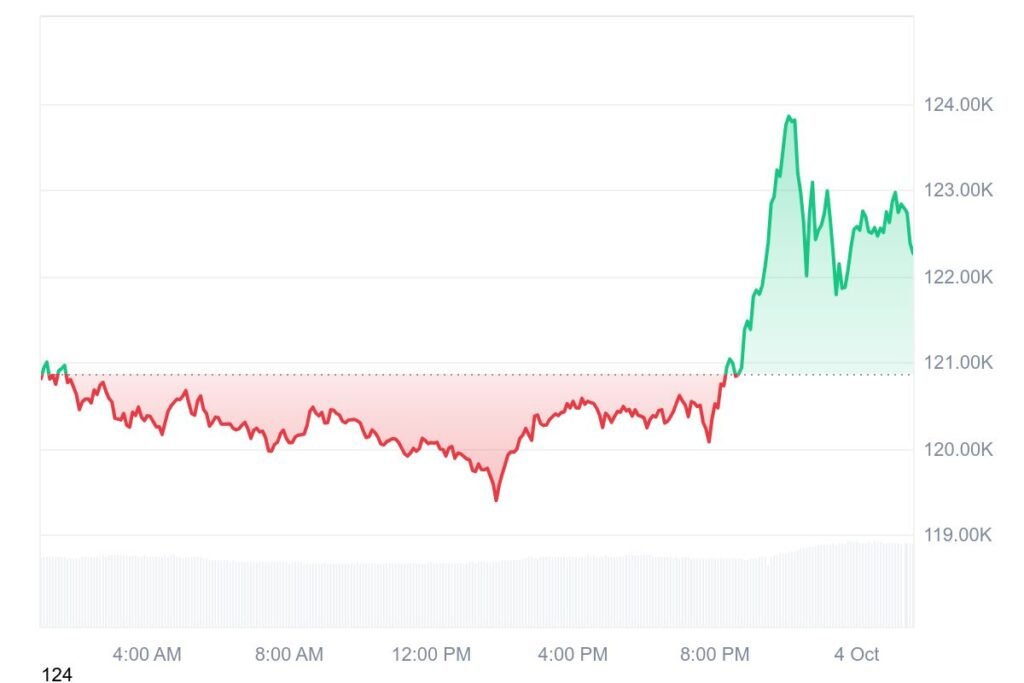

Bitcoin continues to carve out an October bull run, pushing past the $123,000 zone today. The digital asset registered an intraday low near $119,344.31 and soared to a high around $123,944. At the time of writing, BTC was trading near $122,632.Over the past 24 hours, Bitcoin climbed about 1.73%, building on a 12.13% gain for the week, according to CoinMarketCap data. The momentum is being driven by aggressive ETF inflows, growing speculation around Fed rate cuts, and pronounced bullish technical patterns.

$2.2B ETF Inflows Reignite the Rally

Institutional demand is flooding back. In the past 4 days, U.S. spot Bitcoin ETFs drew $2.2 billion in net inflows, with BlackRock alone contributing $466 million.

Moreover, BlackRock’s IBIT holdings have swelled, reflecting its dominant role in regulated crypto exposure.

This renewed ETF appetite shows that large capital is heading into Bitcoin in a regulated wrapper.

Macro Winds at Bitcoin’s Back

Bitcoin’s rally isn’t happening in isolation. Weakness in U.S. services PMI data stirred hopes that the Federal Reserve may ease policies sooner than expected. That narrative plays right into risk assets, where Bitcoin is benefiting from a dovish pivot trade.

Meanwhile, investors view BTC as a potential hedge in a yield-constrained world. With conventional safe havens offering paltry returns, the appeal of a decentralized, digital store of value is resurfacing.

Institutional Conviction & On-Chain Strength

While price action attracts headlines, on-chain data tells a deeper story. In 2025, 92% of new Bitcoin supply is being absorbed by long-term holders, with short-term holders (STHs) at historically low levels.

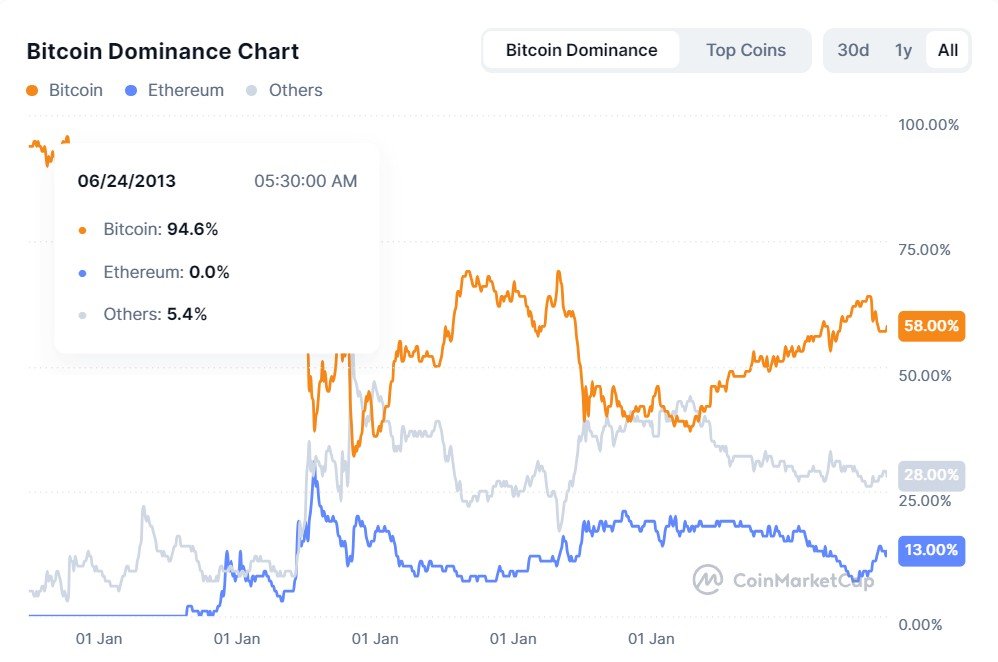

This shift suggests that volatility is dampening and accumulation is becoming more structural rather than speculative. As ETF inflows outpace miner issuance, Bitcoin is underpinned by “real demand” rather than mere momentum chasing.Bitcoin dominance also remains strong, sitting close to 58.1%, indicating that institutions are backing BTC as the market’s anchor.

Technicals Paint a Bullish Frame

From a technical lens, Bitcoin is flirting with its all-time high (~$124,457, touched on August 14, 2025). The current price climb is being driven by strong RSI and MACD signals, which suggest further room to run.

Support zones near recent lows ($119,000–$120,000) have held firm, giving bulls confidence. If buyers can sustain momentum above $123,000, the path toward reclaiming $124,000+ becomes more plausible.

That said, the road ahead isn’t without hazards. A large reversal would require a collapse in ETF inflows or a surprise hawkish turn from the Fed. Retail blow-off tops are also possible in rapid rallies.

Further, altcoins might begin reclaiming capital if rotation sets in — though as long as Bitcoin dominance holds above 55-60%, the trend favors BTC.

Market participants will also be watching upcoming U.S. economic data — especially inflation, jobs, and consumer spending — for any signs of policy pivots.

Bitcoin is riding institutional conviction, macro shifts, and structural supply dynamics. The “Uptober” narrative holds water for now.

If ETF inflows sustain, on-chain metrics remain robust, and the macro backdrop loosens further, Bitcoin has a shot at breaching the $124,000 zone. For now, bulls remain firmly in control.

Read Also: Spacecoin Performs First End-to-End Blockchain Transaction Through Space

Disclaimer: This article is for informational purposes only and does not constitute investment advice.